All Categories

Featured

Table of Contents

It allows you to budget and strategy for the future. You can conveniently factor your life insurance policy into your budget plan since the costs never ever change. You can intend for the future equally as conveniently because you recognize precisely just how much money your enjoyed ones will get in case of your lack.

This is real for people that quit smoking cigarettes or who have a health problem that fixes. In these situations, you'll usually have to go with a brand-new application procedure to obtain a much better rate. If you still need coverage by the time your degree term life plan nears the expiry date, you have a few alternatives.

Many degree term life insurance policy policies come with the alternative to renew insurance coverage on a yearly basis after the preliminary term ends. term life insurance with accelerated death benefit. The cost of your plan will certainly be based upon your present age and it'll raise yearly. This could be a great alternative if you just need to extend your protection for 1 or 2 years or else, it can get costly quite quickly

Level term life insurance is just one of the most affordable insurance coverage options on the marketplace since it uses fundamental protection in the type of death advantage and only lasts for a collection duration of time. At the end of the term, it expires. Entire life insurance, on the other hand, is significantly much more costly than level term life due to the fact that it doesn't end and includes a cash value function.

Cost-Effective Term 100 Life Insurance

Prices may differ by insurance company, term, coverage quantity, wellness course, and state. Degree term is an excellent life insurance alternative for most people, yet depending on your insurance coverage requirements and individual circumstance, it may not be the finest fit for you.

Annual sustainable term life insurance policy has a regard to just one year and can be restored each year. Annual sustainable term life costs are at first less than degree term life costs, yet rates increase each time you renew. This can be an excellent choice if you, for instance, have simply give up smoking cigarettes and need to wait 2 or three years to request a level term policy and be eligible for a reduced rate.

Outstanding Guaranteed Issue Term Life Insurance

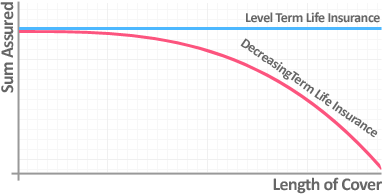

, your fatality benefit payout will decrease over time, but your settlements will remain the same. On the various other hand, you'll pay more ahead of time for much less protection with a raising term life policy than with a level term life plan. If you're not certain which type of plan is best for you, working with an independent broker can aid.

As soon as you've decided that degree term is best for you, the following step is to acquire your plan. Below's just how to do it. Compute just how much life insurance coverage you need Your coverage quantity ought to attend to your household's lasting economic needs, consisting of the loss of your earnings in case of your death, as well as debts and daily expenses.

A degree costs term life insurance policy plan allows you adhere to your budget while you help protect your household. Unlike some stepped rate strategies that raises each year with your age, this type of term strategy supplies rates that stay the very same through you pick, also as you age or your health adjustments.

Discover more about the Life insurance policy alternatives offered to you as an AICPA participant. ___ Aon Insurance Coverage Services is the brand name for the brokerage and program management procedures of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Solutions Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc.

Quality Level Term Life Insurance Meaning

The Plan Representative of the AICPA Insurance Depend On, Aon Insurance Policy Solutions, is not connected with Prudential. Group Insurance policy coverage is provided by The Prudential Insurance Business of America, a Prudential Financial firm, Newark, NJ. 1043476-00002-00.

Latest Posts

Whole Life Final Expense Insurance

Funeral Funds For Seniors

Paying For Funeral With Life Insurance